O2 and NatWest launch pre-paid Visa card

O2 has announced the launch of a Visa pre-paid cash-card service.The mobile phone operator, which is part of the Telefonica group, has joined forces with NatWest to provide the cards, which can be loaded online or at certain retail outlets.They will be useable at any outlet that already accepts Visa debit cards and for cash withdrawals at ATMs, although no form of overdraft facility is available.Customers will be kept updated on their balances with regular SMS text alerts.

The cards will be in circulation from the beginning of August at no charge to O2 customers, including the pay-as-you-go variety, as long as they top up regularly.The launch marks O2’s entry into the UK’s personal finance market and the firm says that further products are planned.According to O2, the mobile payments market could embrace up to 110 million European users by 2014, in a market worth $600 billion.

Friday, September 4, 2009

Britons hide 217,000 credit cards

by Gill Montia

New research from Halifax indicates that Britons have between them over 217,000 credit cards that are kept secret from partners and spouses.According to the lender, they are used to buy items that people would rather their partners didn’t know about and to hide existing debt, while some claim their secret cards are kept solely for emergencies.Purchases made on hidden plastic are relatively modest, with the largest item respondents admitted to buying costing less than £500. The figures also reveal the extent to which people are honest about their credit card usage because only 1% of credit card holders with partners feel the need to hide the truth.However, those who prefer to keep their credit cards close to their chest are reminded by Halifax that when applying for products in joint names, couples may be asked to disclose any outstanding debts.According to APACS, the body representing payments service providers, there are 30.2 million credit card holders in the UK with 71.3 million UK-issued credit and charge cards between them.In 2008, total UK consumer spending with credit cards stood £126.2 billion and 60% of cardholders clear their balance in full each month.

by Gill Montia

New research from Halifax indicates that Britons have between them over 217,000 credit cards that are kept secret from partners and spouses.According to the lender, they are used to buy items that people would rather their partners didn’t know about and to hide existing debt, while some claim their secret cards are kept solely for emergencies.Purchases made on hidden plastic are relatively modest, with the largest item respondents admitted to buying costing less than £500. The figures also reveal the extent to which people are honest about their credit card usage because only 1% of credit card holders with partners feel the need to hide the truth.However, those who prefer to keep their credit cards close to their chest are reminded by Halifax that when applying for products in joint names, couples may be asked to disclose any outstanding debts.According to APACS, the body representing payments service providers, there are 30.2 million credit card holders in the UK with 71.3 million UK-issued credit and charge cards between them.In 2008, total UK consumer spending with credit cards stood £126.2 billion and 60% of cardholders clear their balance in full each month.

Deflation pushes student loan interest rate below zeroby Gill Montia

From today, graduates paying off student loans taken out before 1998 will see their outstanding balances shrink, even when no payments are made.The UK’s government-backed student loans system uses the Retail Prices Index (RPI) to set an annual interest rate, which is applied from 1st September.The RPI measure turned negative in March as the recession deepened, meaning that the rate payable on student loans taken out before 1998 now stands at minus 0.4%.The shift into negative territory is a first for the student loan scheme and according to reports, around 390,000 graduates will benefit.Meanwhile, the Student Loans Company has reduced to zero the rate payable by around 3.26 million students and graduates with loans taken out after 1998.The firm has defended its decision not to apply a deflationary rate, explaining that post 1998 loans are already “well-subsidised”.

From today, graduates paying off student loans taken out before 1998 will see their outstanding balances shrink, even when no payments are made.The UK’s government-backed student loans system uses the Retail Prices Index (RPI) to set an annual interest rate, which is applied from 1st September.The RPI measure turned negative in March as the recession deepened, meaning that the rate payable on student loans taken out before 1998 now stands at minus 0.4%.The shift into negative territory is a first for the student loan scheme and according to reports, around 390,000 graduates will benefit.Meanwhile, the Student Loans Company has reduced to zero the rate payable by around 3.26 million students and graduates with loans taken out after 1998.The firm has defended its decision not to apply a deflationary rate, explaining that post 1998 loans are already “well-subsidised”.

Wednesday, July 15, 2009

Iran, Turkey Reviewed Bilateral Trade Project Code: None Selected

July 15, 2009 Iranian ambassador to Turkey, Iranian and Turkish members of parliament, and the two sides` merchants and tradesmen attended the meeting held on Tuesday. Iranian ambassador Bahaman Hosseinpoor said that the two country`s governments are determined to boost trade especially board trade as a supplementary to official trade between the two countries. In its tenders, Iran mostly prefers Turkish companies, he said referring to Iran`s Razi Petrochemical Complex bought by Turkish Gubretas Company as an indication of such preference. Head of Erzurum Chamber of Commerce and Industry, Lotfi Yojlik, appreciated Tehran`s efforts on expansion of bilateral ties with Ankara. He asked for tariff cuts in order to boost goods transit between the two countries. 2009/07/15 Copyright © 2003-2009 Mojnews Agency. All rights reserved Provided by Syndigate.info an Albawaba.com company

July 15, 2009 Iranian ambassador to Turkey, Iranian and Turkish members of parliament, and the two sides` merchants and tradesmen attended the meeting held on Tuesday. Iranian ambassador Bahaman Hosseinpoor said that the two country`s governments are determined to boost trade especially board trade as a supplementary to official trade between the two countries. In its tenders, Iran mostly prefers Turkish companies, he said referring to Iran`s Razi Petrochemical Complex bought by Turkish Gubretas Company as an indication of such preference. Head of Erzurum Chamber of Commerce and Industry, Lotfi Yojlik, appreciated Tehran`s efforts on expansion of bilateral ties with Ankara. He asked for tariff cuts in order to boost goods transit between the two countries. 2009/07/15 Copyright © 2003-2009 Mojnews Agency. All rights reserved Provided by Syndigate.info an Albawaba.com company

Islamic investment banks need to diversify .

July 13, 2009

Islamic investment banks are too dependent upon real estate for their investment activity and they need to diversify into other asset classes, according to a report published today. Islamic Investment Banking 2009 is published by Yasaar Media and co-published by Unicorn Investment Bank and Doha Islamic.

According to the report, the Islamic finance industry has seen significant shrinkage since the onset of the global financial crisis as the values of investments and deposits have declined in line with global markets.

One of the biggest declines in the crisis has been the value of real estate assets which have tumbled across the globe. The over-reliance of many Islamic investment banks on real estate means that the underlying values of their portfolios have declined too.

The report goes on to argue that a greater diversification into other asset classes would have helped diminish the impact of some of these losses and enabled banks to weather the storm in better shape.

Areas that are particularly ripe for Islamic investment activity include both Islamic private equity and venture capital. Islamic venture capital is a virtually unexplored region of Islamic investment banking and could be set for quick growth when the turnaround comes.

Author of the report, Paul McNamara, editorial director of Yasaar Media, said, ‘The fact is that not enough Islamic investment banks have delved into a diverse range of asset classes and as a result the industry is not as robust as it could be. While not every bank will want to be involved in every area of investment, a healthier spread of asset classes and diversification away from real estate can only serve to produce an industry that is less prone to market dips and more prone to healthy and sustained profitability’.

July 13, 2009

Islamic investment banks are too dependent upon real estate for their investment activity and they need to diversify into other asset classes, according to a report published today. Islamic Investment Banking 2009 is published by Yasaar Media and co-published by Unicorn Investment Bank and Doha Islamic.

According to the report, the Islamic finance industry has seen significant shrinkage since the onset of the global financial crisis as the values of investments and deposits have declined in line with global markets.

One of the biggest declines in the crisis has been the value of real estate assets which have tumbled across the globe. The over-reliance of many Islamic investment banks on real estate means that the underlying values of their portfolios have declined too.

The report goes on to argue that a greater diversification into other asset classes would have helped diminish the impact of some of these losses and enabled banks to weather the storm in better shape.

Areas that are particularly ripe for Islamic investment activity include both Islamic private equity and venture capital. Islamic venture capital is a virtually unexplored region of Islamic investment banking and could be set for quick growth when the turnaround comes.

Author of the report, Paul McNamara, editorial director of Yasaar Media, said, ‘The fact is that not enough Islamic investment banks have delved into a diverse range of asset classes and as a result the industry is not as robust as it could be. While not every bank will want to be involved in every area of investment, a healthier spread of asset classes and diversification away from real estate can only serve to produce an industry that is less prone to market dips and more prone to healthy and sustained profitability’.

Decline In Issuance Of Conventional Bonds And Sukuk Project Code: None Selected

Publication: Bernama Newswire Provider: Pertubuhan Berita Nasional Malaysia (BERNAMA)

July 14, 2009 KUALA LUMPUR, July 13 (Bernama) -- There has been a marked decline in the issuance of both conventional bonds and sukuk (Islamic bonds), according to RAM Rating Services Bhd (RAM Ratings).

The rating house attributed this to the bleak economic landscape, dents in investor confidence and pricing hurdles.

"Although the global economies are expected to stabilise in the coming months, the current performance of the Malaysian bond market is still only modest at best," it said in a statement today.

Despite this, RAM Ratings published ratings of RM22 billion of debt facilities in the first six months this year, capturing about 79 percent of the local bond market.

Of this, only RM6.8 billion has been issued as at end-June, it said.

For the entire market, issuance of ringgit-denominated bonds totalled RM9.6 billion for the same period, about 59 percent lower than the previous corresponding period, according to RAM Ratings.

Similarly, sukuk issuance in first half of this year came up to RM3.9 billion, compared to RM7.3 billion in the same period in 2008, it said.

"The small number of issuance, however, is not indicative of any lack of interest in the bond market, or a dearth in corporates' funding requirements," said RAM Ratings' chief executive officer Liza Mohd Noor.

"The fact that we have close to RM60 billion of rated bonds awaiting issuance amid more conducive conditions testifies to this," she said.

In first half of this year, RAM Ratings' portfolio of issuers was mainly driven by financial institutions, Liza said.

The most recent addition is South Korean issuers Hana Bank, which issued its RM1 billion nominal value multi-currency medium-term notes in June, she said. RAM Ratings said the financial guarantees to be extended by Danajamin Nasional Bhd to investment-grade companies have stirred interest and are expected to help spur bond market activity.

"The setting up of Danajamin is viewed as opening the door to more risk-averse investors, particularly those who have shied away from debt papers with lower than AA ratings," it said.

Apart from papers offered by the larger players, RAM Ratings believes that issuances in the following months will likely be made up of bonds backed by the government or insured by Danajamin.

"These will allow eligible lower-rated issuers to access the bond market for their funding requirements," it said. -- BERNAMA

Publication: Bernama Newswire Provider: Pertubuhan Berita Nasional Malaysia (BERNAMA)

July 14, 2009 KUALA LUMPUR, July 13 (Bernama) -- There has been a marked decline in the issuance of both conventional bonds and sukuk (Islamic bonds), according to RAM Rating Services Bhd (RAM Ratings).

The rating house attributed this to the bleak economic landscape, dents in investor confidence and pricing hurdles.

"Although the global economies are expected to stabilise in the coming months, the current performance of the Malaysian bond market is still only modest at best," it said in a statement today.

Despite this, RAM Ratings published ratings of RM22 billion of debt facilities in the first six months this year, capturing about 79 percent of the local bond market.

Of this, only RM6.8 billion has been issued as at end-June, it said.

For the entire market, issuance of ringgit-denominated bonds totalled RM9.6 billion for the same period, about 59 percent lower than the previous corresponding period, according to RAM Ratings.

Similarly, sukuk issuance in first half of this year came up to RM3.9 billion, compared to RM7.3 billion in the same period in 2008, it said.

"The small number of issuance, however, is not indicative of any lack of interest in the bond market, or a dearth in corporates' funding requirements," said RAM Ratings' chief executive officer Liza Mohd Noor.

"The fact that we have close to RM60 billion of rated bonds awaiting issuance amid more conducive conditions testifies to this," she said.

In first half of this year, RAM Ratings' portfolio of issuers was mainly driven by financial institutions, Liza said.

The most recent addition is South Korean issuers Hana Bank, which issued its RM1 billion nominal value multi-currency medium-term notes in June, she said. RAM Ratings said the financial guarantees to be extended by Danajamin Nasional Bhd to investment-grade companies have stirred interest and are expected to help spur bond market activity.

"The setting up of Danajamin is viewed as opening the door to more risk-averse investors, particularly those who have shied away from debt papers with lower than AA ratings," it said.

Apart from papers offered by the larger players, RAM Ratings believes that issuances in the following months will likely be made up of bonds backed by the government or insured by Danajamin.

"These will allow eligible lower-rated issuers to access the bond market for their funding requirements," it said. -- BERNAMA

Saturday, April 25, 2009

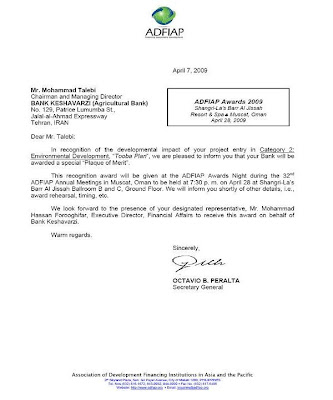

Bank Keshavarzi, the top bank of Asia and the Pacific region in environmental developmen projects

Following the participation of Bank Keshavarzi in outstanding development project awards of Association of Development Financing Institutions in Asia and the Pacific (ADFIAP), Bank Keshavarzi has been awarded a special plaque of Merit among 80 banks and Institutions in 40 countries of the world for its successful performance in Tooba plan, agricultural and environmental development.

This award will be given to the banks representative in a formal awarding ceremony on April 28, 2009 in Muscat, Oman on the occasion of the 32nd annual meeting of ADFIAP.

Last year Bank Keshavarzi had been also recognized as the top bank by ADFIAP and awarded for its Hazrat Zeynab project in Development Finance-led poverty Reduction category.

Monday, March 9, 2009

UBL:Ameen and Bank Keshavarzi lead sharia growth Lists

The leading countries in the world, based on sharia-compliant assets (SCAs), are determined not only by the size of each country’s overall financial sector but also by the degree to which the country is sharia ¬compliant. As economies evolve and financial institutions do more business through Islamic or sharia-compliant channels, leading countries such as Saudi Arabia, Malaysia and Kuwait will rise up the rankings.

Heading the fastest growing by percentage change is Pakistan’s UBL Ameen with growth of 3925.2%. This is followed by one of the major banks in the entire listing, Saudi Arabia’s Al Rajhi Bank, which shows growth of 772.1%, and then Pakistan’s Askari Bank and National Bank of Pakistan with growth of 600.5% and 366.2%, respectively.

Included in these leading fast-growers are also a number of insurance companies: Watania Co-operative Insurance Company, El Nilein Insurance Company and Allied Co-operative Insurance Group, which have growth rates of 314.6%, 300.9% and 275.7%, respectively. Heading the fastest growing group in dollar terms is the Iranian bank, Bank Keshavarzi, with growth of $16.3bn in SCAs. Kuwait Finance House is another significant mover, jumping up by $9.5bn in SCAs.

Among the leading 10 institutions in this growth category are six Iranian banks, which all claim that their entire financial assets are 100% sharia compliant. As a mark of new players in this field the UK-based HSBC Amanah is placed sixth on this growth table, with expansion of $5.5bn in SCAs.

http://www.thebanker.com/news/fullstory.php/aid/6131/UBLAmeen_and_Bank_Keshavarzi_lead_sharia_growth_lists.html

Friday, February 27, 2009

Saturday, February 21, 2009

Overview of Bank Keshavarzi

Bank Keshavarzi was founded in 1933 as Farming and Industrial Bank. Today, having 71 years of experience, it serves as the only specialized financial institution in the agricultural sector that holds over 1800 branches nationwide and finances nearly 70% of the sector. During the past decade, the bank has been successful in meeting its mission and objectives, especially the required finances of the agricultural sector, through active participation in financial markets and relying on adequate resource mobilization.

Credit and savings growth of the bank, presumably the two essential pillars in banking operations, represent a brighter horizon and remarkable prosperities in achieving the today standards of a modern and developed bank.

In the 70th anniversary of its establishment, and within the overall policies of government in the agricultural sector, Bank Keshavarzi endeavored to provide the working capital and the required facilities available to sustain and utilize the available production capacities through injecting Rls. 28753.7 billion for as many as 1513729 credits to the agricultural sector investing on promotion of production capacities of the agricultural sector as well as job creation. The growing number of credits in 2003 as compared with last year has reached up to 11.3%, and as for the amount of credits it has grown up to 27.2%. Out of the total disbursed credits in 2003, about 146981 has been statutory credits as much as Rls. 5881.7 billion , and nearly 1366748 has been dedicated to non-statutory ones amounting to Rls. 22872 billion.

The growth of statutory credits in the reported year as compared with the previous one has reached up to 5.3% in number and up to 4.2% in amount. Also, the growth of non-statutory credits has been 11.9% in number and 34.8% in amount.

Due to the restricted water and soil resources, Bank Keshavarzi makes annually major financial credits disbursement to implement diverse water and soil projects, including dam-making projects, building floodgates to utilize surface water, handling water-shedding and underground reservoirs, leveling and draining lands, and covering water irrigation channels.

In 2003, just like proceeding years, mobilizing financial resources had been of high priority to meet the requirements of the agricultural sector.

In order to make further diversity in banking services and to meet the requirements of activists in the agricultural sector as well as other sectors, BK has endeavored extensively in recent years to expand international banking services in the field of international Forex services and their financial resources.

Focusing on the importance of electronic banking, BK has initiated its major project on the electronic banking since 2001 under the title of MEHR, i.e. smart computer management. Bank Keshavarzi has been the first bank to join the banking information exchange network, known as SHETAB Network, and the whole ATMs of operating banks in Bahrain. Accordingly, BK has so far been able to offer the best services to the customers through installing 302 ATMs and 300 POS nationwide and to issue the MEHR credit card ever offered during the history of baking in Iran for the first time. The MEHR card holders are able to shop at chain stores and other welfare centers in which point of sales (POS) are installed. For the meantime, the number of MEHR cards ever issued up to the mid 2004 amounts to 449000, the number of credit cards issued are as many as 980, and the number of branches set for MEHR cards throughout the country amounts to 302.

Bank Keshavarzi has also installed and run a telephone operating system to help customers with their accounts information. For the first time in the national banking system, an electronic queuing system has been utilized in a number of branches nationwide to reduce the number of crowed people and their irregular stance before the branch windows. As a result of positive outcomes of the above project, it is believed that other branches of BK will be definitely furnished with the above system.

Aiming to serve its own customers as well as other people, Bank Keshavarzi took the initiative and established a 24/7 call center titled Green Communication Center. It serves to people, farmers, and activists in the agricultural sector.

The Qard-al-Hassaneh savings account specially designed for agriculture was added to the scope of services offered by BK. It has been mainly designed to absorb the income obtained from agricultural crops, especially wheat. In addition, other people are also allowed to open the above account.

Bank Keshavarzi took it into account to activate a Kids Bank as well aiming at teaching kids about the concepts of savings, future plans, and bankability along with the overall policies of the bank, and later to expand it throughout the branches in Tehran at the first stage and provincial directorates at the second one.

In 2003 a pilot branch was exclusively designed for Tehran in which the services are now offered to kids and youngsters. For the meantime, though, there are 85 branches across Tehran holding special windows for services offered to kids and youngsters. Similar windows have recently been opened in the whole provincial directorates.

To name further modern plans and services by the bank, we can point to the special services offered to women -- namely Iran Plan, and Hazrate Zaynabe Kobra Plan – Atiyeh Investment Account, Easy Deposit Plan – short term deposit account enabling holders to endorse the account notes in favor of others – participation in the stock market, Special Observers Plan, etc.

Included in the mission and objectives of the bank have been the establishment of Helping Fund for Livestock and Agricultural Damaged Producers , and Agricultural Products Insurance Fund. The former fund aims at supporting the activities of agricultural sector in different ways as exposed to damages and losses gained from natural hazards. In 2003, the fund paid about Rls. 388.3 billion for damages and some 81% of total credits absorbed in 2003 are associated with the damage caused by drought and the rest are related to other disasters.

Agricultural Products Insurance Fund has been able to cover the insurance for farming, horticulture, livestock, poultry, aquaculture, and natural resources during its 20 years of consecutive operation.

brief description of BK's achievements is as follows:

• Design, implementation and installation of Core Banking System (Mehr Gostar) for the first time in Iranian banking system;

• Development and expansion of Quality Management System throughout the bank;

• Constant reengineering of business practices and procedures, as well as organizational flexibility;

• Concentration on human capital ( training , empowering, and customer-oriented workshops);

• Utilizing the latest findings and achievements in bank marketing;

• Structuring relation management with main customers through special agreements;

• Structuring Customer Relation Management (CMR)

BK's Innovations

• Localization and Implementation of Core Banking Software (Mehr Gostar);

• The first 24/7 call center;

• Implementation and installation of Branch Electronic Queuing System;

• Organizer of the first group of member banks in SHETAB Network;

• Design and implementation of voice mail and communication terminal between customers and BK's senior managers;

• Design and implementation of Lobby Tellers Project;

• Design and implementation of a website in banking system of the country;

• Design and implementation of Atiye (Future) Project in banking system;

• Design and establishment of Kids Bank

• Design and issuance of credit cards in the banking system;

• Design and implementation of Customers Supervision on Branch Affairs Project;

Bank Keshavarzi was founded in 1933 as Farming and Industrial Bank. Today, having 71 years of experience, it serves as the only specialized financial institution in the agricultural sector that holds over 1800 branches nationwide and finances nearly 70% of the sector. During the past decade, the bank has been successful in meeting its mission and objectives, especially the required finances of the agricultural sector, through active participation in financial markets and relying on adequate resource mobilization.

Credit and savings growth of the bank, presumably the two essential pillars in banking operations, represent a brighter horizon and remarkable prosperities in achieving the today standards of a modern and developed bank.

In the 70th anniversary of its establishment, and within the overall policies of government in the agricultural sector, Bank Keshavarzi endeavored to provide the working capital and the required facilities available to sustain and utilize the available production capacities through injecting Rls. 28753.7 billion for as many as 1513729 credits to the agricultural sector investing on promotion of production capacities of the agricultural sector as well as job creation. The growing number of credits in 2003 as compared with last year has reached up to 11.3%, and as for the amount of credits it has grown up to 27.2%. Out of the total disbursed credits in 2003, about 146981 has been statutory credits as much as Rls. 5881.7 billion , and nearly 1366748 has been dedicated to non-statutory ones amounting to Rls. 22872 billion.

The growth of statutory credits in the reported year as compared with the previous one has reached up to 5.3% in number and up to 4.2% in amount. Also, the growth of non-statutory credits has been 11.9% in number and 34.8% in amount.

Due to the restricted water and soil resources, Bank Keshavarzi makes annually major financial credits disbursement to implement diverse water and soil projects, including dam-making projects, building floodgates to utilize surface water, handling water-shedding and underground reservoirs, leveling and draining lands, and covering water irrigation channels.

In 2003, just like proceeding years, mobilizing financial resources had been of high priority to meet the requirements of the agricultural sector.

In order to make further diversity in banking services and to meet the requirements of activists in the agricultural sector as well as other sectors, BK has endeavored extensively in recent years to expand international banking services in the field of international Forex services and their financial resources.

Focusing on the importance of electronic banking, BK has initiated its major project on the electronic banking since 2001 under the title of MEHR, i.e. smart computer management. Bank Keshavarzi has been the first bank to join the banking information exchange network, known as SHETAB Network, and the whole ATMs of operating banks in Bahrain. Accordingly, BK has so far been able to offer the best services to the customers through installing 302 ATMs and 300 POS nationwide and to issue the MEHR credit card ever offered during the history of baking in Iran for the first time. The MEHR card holders are able to shop at chain stores and other welfare centers in which point of sales (POS) are installed. For the meantime, the number of MEHR cards ever issued up to the mid 2004 amounts to 449000, the number of credit cards issued are as many as 980, and the number of branches set for MEHR cards throughout the country amounts to 302.

Bank Keshavarzi has also installed and run a telephone operating system to help customers with their accounts information. For the first time in the national banking system, an electronic queuing system has been utilized in a number of branches nationwide to reduce the number of crowed people and their irregular stance before the branch windows. As a result of positive outcomes of the above project, it is believed that other branches of BK will be definitely furnished with the above system.

Aiming to serve its own customers as well as other people, Bank Keshavarzi took the initiative and established a 24/7 call center titled Green Communication Center. It serves to people, farmers, and activists in the agricultural sector.

The Qard-al-Hassaneh savings account specially designed for agriculture was added to the scope of services offered by BK. It has been mainly designed to absorb the income obtained from agricultural crops, especially wheat. In addition, other people are also allowed to open the above account.

Bank Keshavarzi took it into account to activate a Kids Bank as well aiming at teaching kids about the concepts of savings, future plans, and bankability along with the overall policies of the bank, and later to expand it throughout the branches in Tehran at the first stage and provincial directorates at the second one.

In 2003 a pilot branch was exclusively designed for Tehran in which the services are now offered to kids and youngsters. For the meantime, though, there are 85 branches across Tehran holding special windows for services offered to kids and youngsters. Similar windows have recently been opened in the whole provincial directorates.

To name further modern plans and services by the bank, we can point to the special services offered to women -- namely Iran Plan, and Hazrate Zaynabe Kobra Plan – Atiyeh Investment Account, Easy Deposit Plan – short term deposit account enabling holders to endorse the account notes in favor of others – participation in the stock market, Special Observers Plan, etc.

Included in the mission and objectives of the bank have been the establishment of Helping Fund for Livestock and Agricultural Damaged Producers , and Agricultural Products Insurance Fund. The former fund aims at supporting the activities of agricultural sector in different ways as exposed to damages and losses gained from natural hazards. In 2003, the fund paid about Rls. 388.3 billion for damages and some 81% of total credits absorbed in 2003 are associated with the damage caused by drought and the rest are related to other disasters.

Agricultural Products Insurance Fund has been able to cover the insurance for farming, horticulture, livestock, poultry, aquaculture, and natural resources during its 20 years of consecutive operation.

brief description of BK's achievements is as follows:

• Design, implementation and installation of Core Banking System (Mehr Gostar) for the first time in Iranian banking system;

• Development and expansion of Quality Management System throughout the bank;

• Constant reengineering of business practices and procedures, as well as organizational flexibility;

• Concentration on human capital ( training , empowering, and customer-oriented workshops);

• Utilizing the latest findings and achievements in bank marketing;

• Structuring relation management with main customers through special agreements;

• Structuring Customer Relation Management (CMR)

BK's Innovations

• Localization and Implementation of Core Banking Software (Mehr Gostar);

• The first 24/7 call center;

• Implementation and installation of Branch Electronic Queuing System;

• Organizer of the first group of member banks in SHETAB Network;

• Design and implementation of voice mail and communication terminal between customers and BK's senior managers;

• Design and implementation of Lobby Tellers Project;

• Design and implementation of a website in banking system of the country;

• Design and implementation of Atiye (Future) Project in banking system;

• Design and establishment of Kids Bank

• Design and issuance of credit cards in the banking system;

• Design and implementation of Customers Supervision on Branch Affairs Project;

Subscribe to:

Posts (Atom)